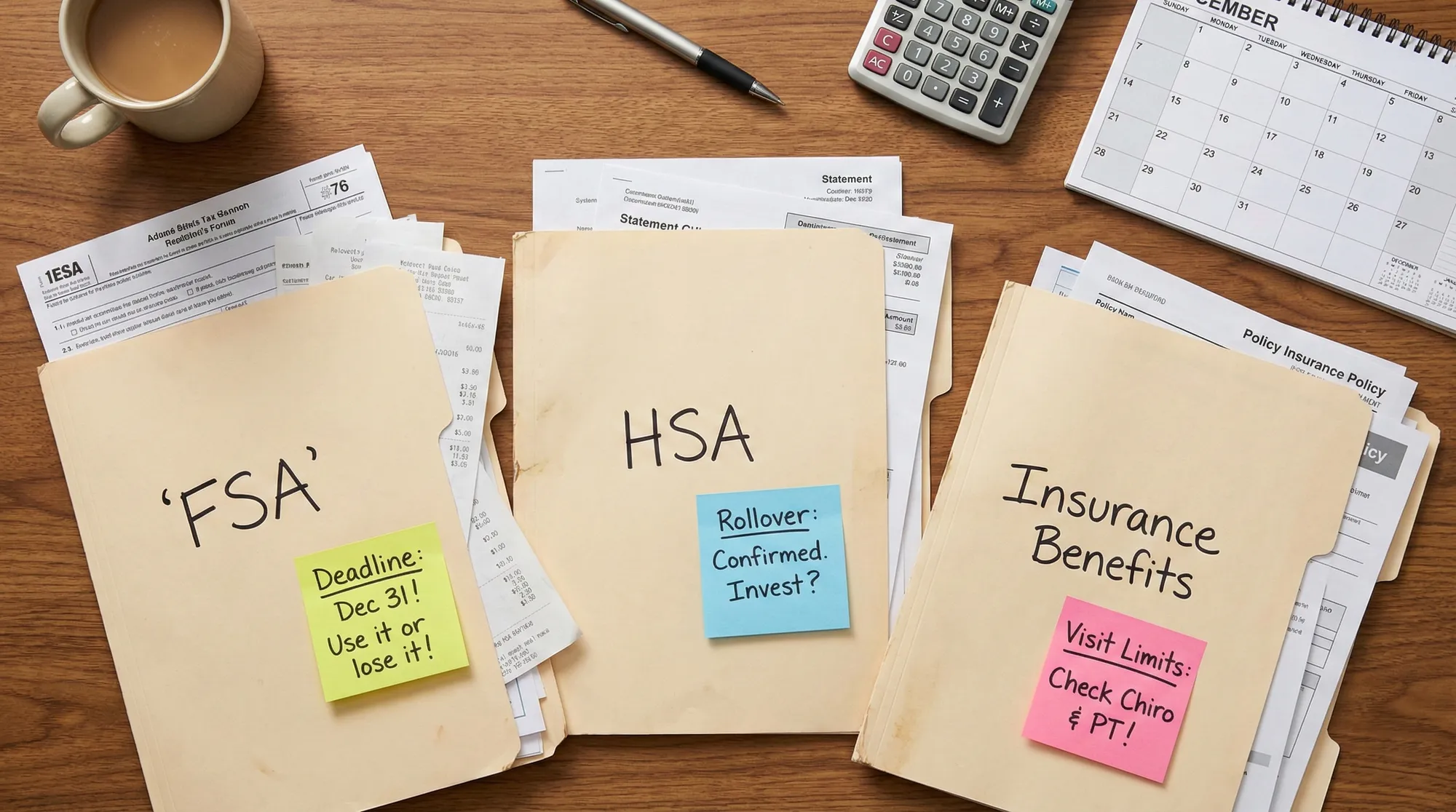

As the year winds down, most people think about holiday plans, family gatherings, and last‑minute shopping. What often gets ignored? Health benefits that quietly expire on December 31.

If you have health insurance, an FSA (Flexible Spending Account), or an HSA (Health Savings Account), there is a good chance you still have money on the table. For many plans, if you don’t use those dollars by year‑end, you lose them — and that could mean missing out on care you actually need, including chiropractic and wellness visits that help you move, feel, and live better.[1][2]

This guide walks you through what typically expires, what may roll over, and how The Well‑House Chiropractic in Chillicothe, MO can help you put those benefits to good use before the clock runs out.

Why “Use-It-Or-Lose-It” Matters for Your Health (Not Just Your Wallet)

Year‑end benefits are about more than money.

- If you have been living with back pain, neck pain, headaches, or joint stiffness, there’s a good chance your plan already set aside dollars for you to finally address it.

- Many plans cover chiropractic visits, physical medicine, or preventive care up to a certain limit. If you don’t schedule those visits, the benefits vanish — and so does the chance to get ahead of your pain.

- For FSA users, contributions are pre‑tax and must usually be used in the same plan year, with only limited grace periods or small rollovers allowed.[3][4]

In other words: you’ve already paid for care. The end of the year is your reminder to actually receive it.

FSA vs. HSA vs. Insurance: What Typically Expires?

Every employer and insurance carrier is a bit different, and you should always check your specific plan. But here’s a plain‑English breakdown of what usually happens at year‑end.[3][1]

1. Flexible Spending Accounts (FSAs): Classic “Use-It-Or-Lose-It”

An FSA lets you set aside pre‑tax dollars for qualified medical expenses. In exchange for the tax break, there’s a catch:

- Most FSA dollars must be used within the plan year.

- Employers can choose one of two small relief options:

- A grace period (often up to 2½ months into the next year) to spend remaining funds or

- A limited rollover of up to a capped amount (for 2025 plan years, the IRS increased the health FSA salary reduction contribution limit and the associated carryover cap).[3]

- If you don’t use your eligible dollars by the deadline, the remaining balance is forfeited.

That’s where appointments like chiropractic care, exams, and approved wellness services often come in. Many of these services qualify as FSA‑eligible medical expenses, making December a powerful time to schedule needed visits.[1]

2. Health Savings Accounts (HSAs): More Flexible, But Still Time‑Sensitive

HSAs are more flexible than FSAs:

- Unused HSA funds roll over from year to year and can grow over time.

- HSAs are tied to high‑deductible health plans (HDHPs), and contributions, growth, and eligible withdrawals are usually tax‑advantaged.[5]

So why think about your HSA at year‑end?

- It’s a great moment to review your HSA balance and decide how much you want to contribute for the new year.

- If you have lingering issues (like chronic back pain, frequent headaches, or a nagging sports injury), using your HSA to invest in chiropractic and wellness care now can help prevent bigger, more expensive problems later.

3. Traditional Insurance Benefits: Visit Limits and Deductibles

Even if you do not have an FSA or HSA, your health insurance plan likely has year‑based structures such as:

- Annual visit limits for chiropractic or physical medicine

- Annual deductibles and out‑of‑pocket maximums

- Preventive or wellness benefits that reset each calendar year

For many patients:

- If you have already met your deductible for 2025, year‑end visits may be covered at a higher percentage.

- If you have chiropractic visit limits, unused visits often do not roll into the next year.

Checking your benefits now helps you plan smart: you may be able to get a few extra adjustments or wellness visits at a lower cost before everything resets on January 1.

Are Chiropractic Visits Covered by FSAs, HSAs, or Insurance?

In many cases, yes – but the exact details depend on your plan.

Common patterns (always confirm with your benefits or HR team):

- FSAs: Chiropractic treatment is widely recognized as an eligible medical expense when it’s used to diagnose, treat, or prevent a medical condition (such as back pain, neck pain, sciatica, headaches, etc.).[1]

- HSAs: Similarly, medically necessary chiropractic services often qualify as HSA‑eligible expenses, meaning you can pay with HSA funds.

- Insurance: Many health insurance plans include chiropractic benefits, sometimes with:

- A set number of covered visits per year

- A copay or coinsurance per visit

- Requirements for a diagnosis code or documentation

Even if The Well‑House Chiropractic primarily operates on a cash‑friendly model, most patients can often:

- Use FSA or HSA cards directly, or

- Receive a detailed receipt / superbill to submit for reimbursement through their plan.

Bottom line: For many Chillicothe‑area patients, year‑end is an ideal time to schedule those “tune‑up” adjustments, ergonomic check‑ups, or care for lingering pain using money that is already allocated for your health.

7 Smart Steps to Use Your 2025 Benefits Before They Disappear

Here’s a simple, step‑by‑step checklist you can follow this week.

1. Log In to Your Benefits Portal

Take 5–10 minutes to check:

- Current FSA balance and any posted rules about:

- Current HSA balance and contribution history

- Chiropractic coverage details under your medical plan

- Visit limits

- Copays / coinsurance

- Whether a referral is needed

2. Make a Short “Body Audit” List

Ask yourself:

- Where am I consistently uncomfortable? (neck, lower back, hips, headaches, shoulder, etc.)

- What activities am I avoiding because of pain or stiffness?

- Have I been dealing with issues like sciatica, tension headaches, poor posture, or recurring sports injuries?

Write down 2–3 priority issues. These become your focus for year‑end care at The Well‑House Chiropractic.

3. Check Your Calendar Around Holidays

December fills up fast with:

- School concerts

- Family gatherings

- Travel

- Office parties

Add to that the fact that many healthcare offices adjust hours or close during holidays, and it’s easy to run out of appointment slots.

At The Well‑House Chiropractic, we encourage patients to book early in December so you can:

- Secure times that work with your schedule

- Avoid last‑minute scrambles during the final week of the year

- Ensure any progressive care plans (for complex issues) can start now, not months later

4. Schedule Your Year‑End Chiropractic “Tune‑Up”

Whether you are:

- An office worker with tech‑neck and shoulder tension

- A busy parent who has put off their own care

- A farmer, nurse, or manual worker whose body is feeling the load

- A senior wanting to stay mobile and independent

A targeted chiropractic visit before year‑end can:

- Relieve pain and stiffness

- Improve posture and movement

- Reset your body before the extra stress of travel, long drives, or winter chores

If your plan allows it, ask about booking a follow‑up as well — for example, one visit before the holidays and one shortly after, using the last of your 2025 benefits.

5. Use FSA/HSA Dollars for Related Wellness Expenses

Depending on your plan, you may also be able to use remaining funds for:

- Supportive devices (braces, supports, posture aids)

- Over‑the‑counter pain relief / heat wraps when medically recommended

- Other eligible supplies that support your care plan and comfort[4]

Always confirm eligibility with your plan administrator before purchasing.

6. Save Your Receipts and Documentation

Ask The Well‑House Chiropractic to provide:

- Itemized receipts or superbills with:

- Dates of service

- CPT / diagnosis codes (when appropriate)

- Amounts paid

This makes it easier to:

- File claims for FSA reimbursement

- Keep records for HSA withdrawals

- Track health expenses for your own budgeting

7. Plan Ahead for 2026 Contributions

Once you see how valuable your benefits truly are, use this moment to:

- Adjust your FSA elections (if you under‑ or over‑funded this year)

- Revisit whether an HSA‑eligible HDHP is a good fit for your family

- Build in a regular care rhythm (for example, monthly or quarterly adjustments) so benefits are used steadily throughout the year, not in a December rush

How The Well‑House Chiropractic Helps Chillicothe Patients Maximize Benefits

At The Well‑House Chiropractic, we blend chiropractic expertise with a whole‑person, nursing‑informed approach to care. For local patients trying to make smarter use of their benefits, we can help you:

- Review your care needs and help you prioritize:

- Pain relief (back, neck, sciatica, headaches)

- Performance and mobility (for workers, athletes, and active seniors)

- Preventive and wellness visits

- Provide clear documentation and receipts so you can confidently submit FSA/HSA claims.

- Offer a welcoming, family‑friendly clinic environment where seniors, parents, kids, and athletes alike feel comfortable and cared for.

We understand that money is tight for many families, especially during the holidays. Using pre‑tax dollars and existing benefits for care you actually need is one of the smartest year‑end financial moves you can make.

When Should You Book Your Appointment?

When Should You Book Your Appointment?

Given publishing date (mid‑December 2025) and common FSA deadlines:

- Aim to book within the next 3–7 days to secure a spot before year‑end.

- If your plan has a grace period or rollover, you still benefit from getting care now and starting the new year feeling better.

Call The Well‑House Chiropractic or book online today to: - Check available December slots - Confirm how we can support FSA/HSA usage and documentation - Start closing out 2025 with less pain and more peace of mind

Now Scheduling

FAQs

What does “use-it-or-lose-it” actually mean?

For many health FSAs, any money you don’t spend by your plan’s deadline is forfeited back to the plan, unless your employer offers a limited grace period or a small rollover option.[3] That’s why it’s important to check your balance and schedule eligible care — like chiropractic visits — before your deadline hits.

Are chiropractic visits FSA-eligible?

In most cases, yes, as long as the care is medically necessary (for example, to treat back pain, neck pain, headaches, or other documented conditions). Chiropractic is widely recognized as an eligible medical expense for FSA funds, but always verify with your specific plan or HR team.[1]

Can I use my HSA to pay for chiropractic care?

Often, yes. If you are covered by an HSA‑qualified high‑deductible health plan, many medically necessary chiropractic services are qualified medical expenses you can pay for with your HSA. Check your plan documentation or HSA administrator to confirm.[5]

What if The Well-House Chiropractic is out-of-network for my insurance?

Many patients in and around Chillicothe:

- Pay at the time of service, then

- Use FSA/HSA cards or

- Submit superbills to their plan for out‑of‑network reimbursement (if allowed)

We can provide clear receipts and documentation so you can pursue reimbursement where your plan allows.

How do I know how many chiropractic visits my insurance covers each year?

Log in to your insurance portal or call the customer service number on your card. Ask specifically about:

- Chiropractic visit limits per year

- Copays/coinsurance for chiropractic

- Whether you need a referral or pre‑authorization

If you share that information with us when you schedule, we can help you plan care that makes the most of any remaining visits for 2025.

Is it too late to book an appointment for this year?

If you are reading this in mid‑to‑late December, it’s not too late, but spots may be limited. Call The Well‑House Chiropractic as soon as possible. If we can’t fit you in before your FSA deadline, we can help you plan early visits for the new year and discuss how to better use benefits throughout 2026.

Sources:

- Alera Group – “Legal Alert: IRS Adjusts Health Flexible Spending Account and Other Benefit Limits for 2025.” Explains updated FSA contribution limits and carryover rules.[3]

- The Motley Fool – “What You Can (and Should) Buy With Your 2025 FSA Before the Year Ends.” Overview of FSA use‑it‑or‑lose‑it rules and eligible expenses.[1]

- The Motley Fool – “FSA Shopping Guide: Eligible Items to Buy Before the 2025 Cutoff.” Examples of qualified FSA expenses as deadlines approach.[4]

- U.S. News & World Report (via WTOP) – “Use Your FSA Balance Before it Expires.” General reminders on FSA deadlines and planning.[2]

- Federal News Network – “Feds with Benefits: Proposed 2025 budget bill will make health savings accounts more generous.” Context on HSA rules and recent legislative updates.[5]